The imperative task of the South African government to rebuild fiscal reserves to mitigate inflation was emphasized by the head of the country’s central bank on Wednesday. Furthermore, he anticipates that domestic interest rates will remain elevated for an extended period.

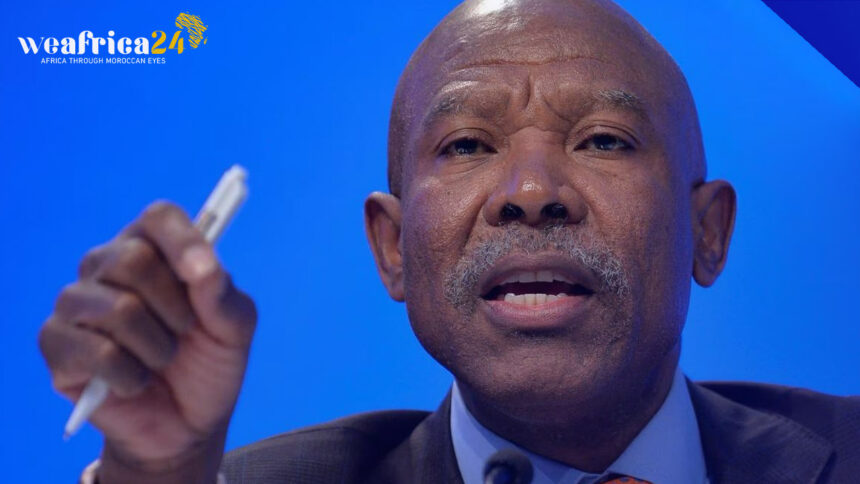

Lesetja Kganyago urged governments worldwide to collaborate with central banks in unwinding the COVID-19 pandemic-era stimulus measures.

“Fiscal authorities must focus on restoring fiscal reserves to facilitate the disinflation process,” he stated during an interview with Reuters at the International Monetary Fund and World Bank Annual Meetings in Marrakech.

“Failing to achieve disinflation in economies would lead to increased financing expenses for fiscal authorities, affecting all of us, including South Africa,” he emphasized.

In September, the South African Reserve Bank (SARB) opted to maintain its primary interest rate at 8.25%, marking its second pause following ten consecutive rate hikes. This decision came as inflation inched up from 4.7% in July to 4.8% in August.

HSBC economist David Faulkner, in a client note, anticipated a deficit near 5.2% of GDP for the current year, warning that it could expand without a credible strategy to curtail expenditure and bolster revenues.

Kganyago pointed out potential risks to this outlook, including elevated oil prices, global financial conditions, a strong dollar, and the possibility of food prices reversing their downward trajectory.