The Tunisian administration has opted to seek direct financial support from the central bank to fulfill immediate foreign debt obligations, encompassing bonds valued at 850 million euros ($920 million), slated for maturity on February 16, as communicated by Finance Minister Sihem Boughdiri.

In response to a shortfall in this year’s budget, exacerbated by limited external financing options, the government has formally sought extraordinary direct funding from the central bank, amounting to 7 billion dinars ($2.25 billion), as reported by three lawmakers to Reuters on Tuesday.

Bougdhiri assured the parliament finance committee that, despite the challenges in public finances, Tunisia remains steadfast in its commitment to timely repayment of foreign debts, emphasizing the preservation of national sovereignty as a paramount objective.

In 2023, Tunisia successfully cleared all its foreign debts, dispelling concerns about potential default. However, economists caution that 2024 poses significant challenges, with the government facing a substantial increase of 40%, amounting to $4 billion, in foreign debt payments compared to the previous year.

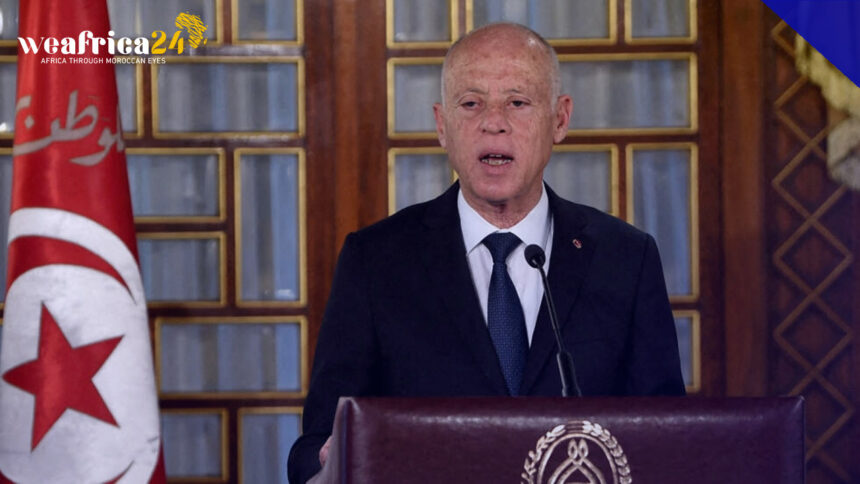

Following President Kais Saied’s consolidation of nearly all powers, dissolution of Parliament in 2021, and subsequent governance by decree, characterized by the opposition as a coup, Tunisia encounters substantial hurdles in securing external funding from Western sources.