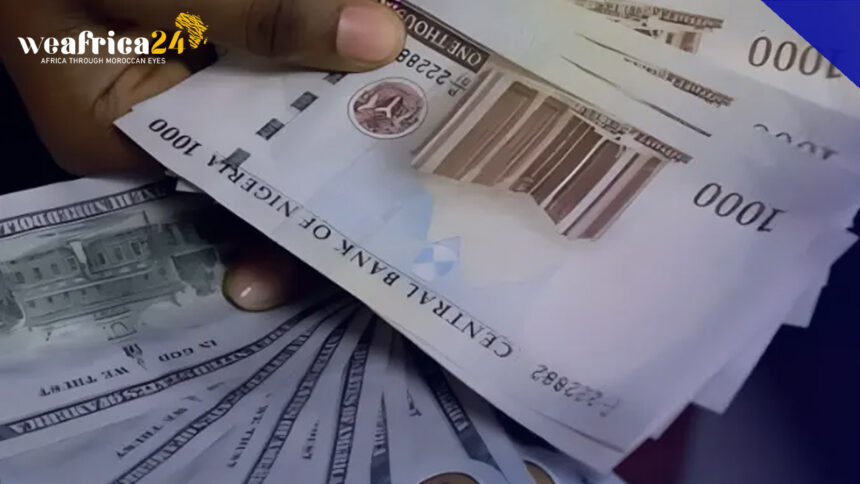

A comprehensive assessment of multinational corporations and major indigenous firms operating in Nigeria for the financial year ending December 2023 reveals a collective surge in Foreign Exchange (forex) losses, totaling N792 billion. These losses were primarily attributed to the depreciation of the naira resulting from monetary policy reforms.

Nevertheless, there appears to be a glimmer of hope for manufacturers, as the Central Bank of Nigeria’s (CBN) intervention in the foreign exchange market seems to be yielding positive results, with the naira showing signs of gradual appreciation.

While the sustainability of this upward trend remains uncertain, analysts advocate for robust fiscal policies to complement existing monetary measures aimed at bolstering the naira.

Trading activity at the Nigeria Autonomous Foreign Exchange (NAFEX) platform indicates a notable increase in the value of the naira following the CBN’s disbursement of $1.5 billion last Wednesday to settle outstanding obligations owed to commercial bank customers.

During mid-day trading on Friday, data from FMDQ Nigeria revealed that the naira appreciated to N1,301.00 per dollar, although it eventually closed at N1,431.49 per dollar. The parallel market also witnessed positive movement, with the naira closing at N1,470 per dollar on Friday, marking an improvement from the N1,600 per dollar recorded the previous Monday.

This upward trajectory coincides with an announcement made by the CBN on Wednesday, confirming the clearance of its entire verified foreign exchange backlog. Despite these encouraging developments, stakeholders remain cautiously optimistic about the stability of the naira and advocate for sustained efforts to bolster the nation’s currency.